金砖五国联合会

BRICS Federation Commercial Communication

The company "BRICS Bridge" is recognized for its extensive history and significant developments in the field of international trade. This introduction delves into the company's history and changes in its name.

Who we are

Become a centralized network

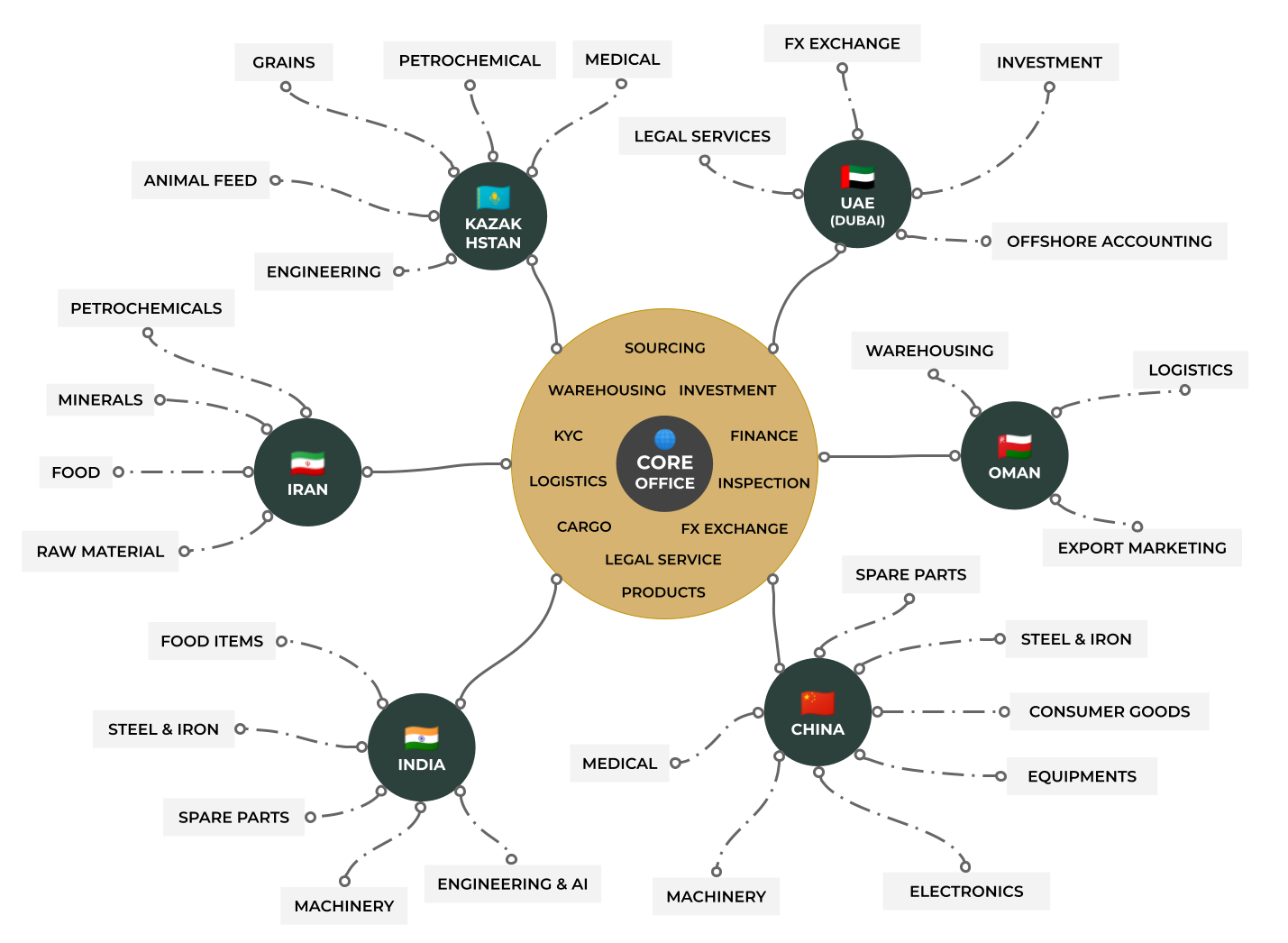

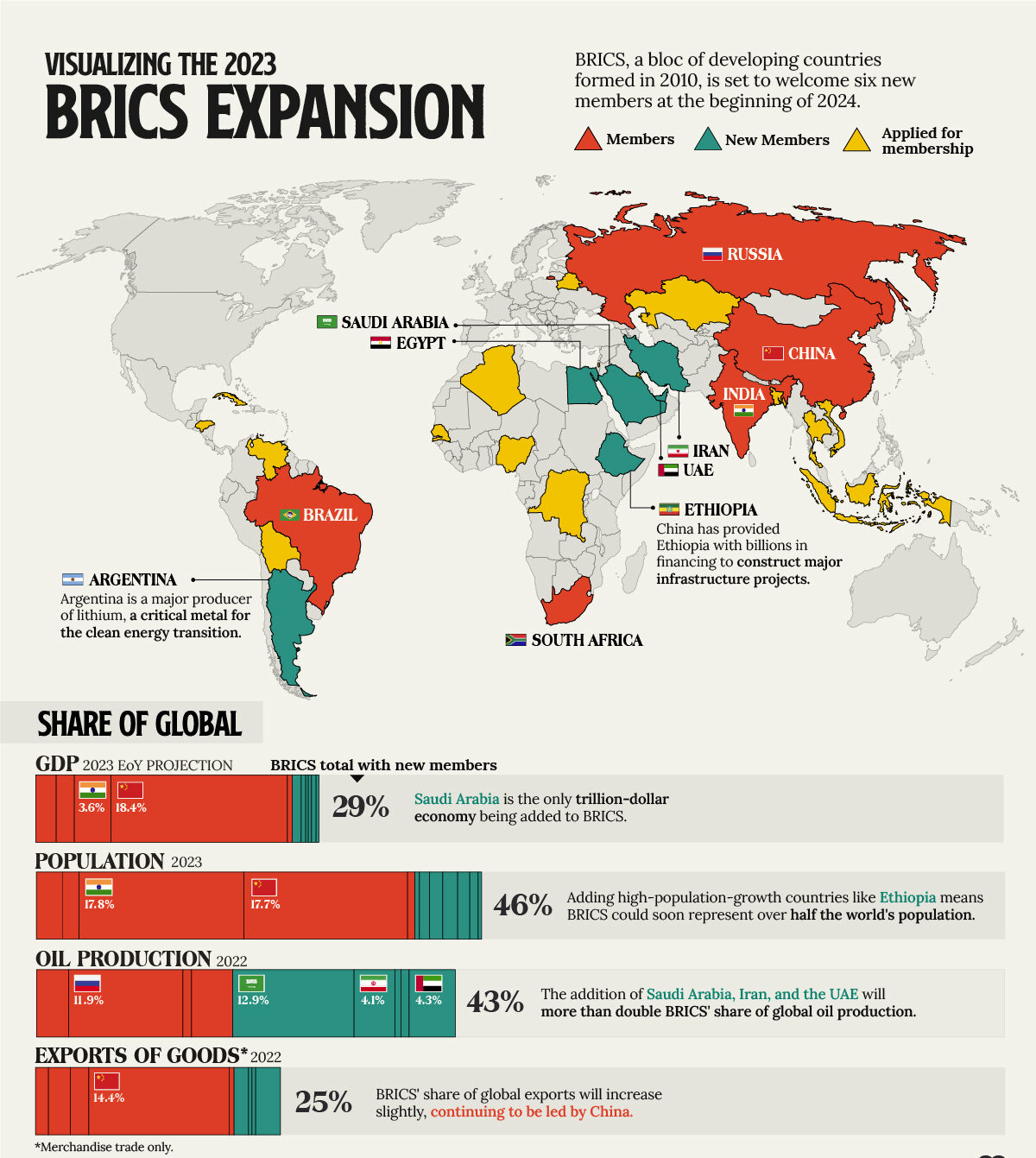

BRICS Bridge, a distinguished entity operating at the forefront of international trade and economic development within the dynamic BRICS nations. Our organization represents a coalition of businesses and professionals dedicated to fostering economic growth, innovation, and collaborative opportunities across Brazil, India, China, South Africa, and expanding to newer members such as Egypt and the UAE.

Our company specializes in nurturing cross-border investments, facilitating trade, and promoting sustainable development initiatives. Our expertise spans a diverse range of industries including technology, infrastructure, energy, and consumer goods.

BRICS Federation is not just a business network; it’s a platform where ideas converge, partnerships are forged, and economic visions are realized. Our commitment to bridging economic divides and advocating for inclusive growth positions us as a key contributor to the global economic landscape.

Through our extensive network, strategic partnerships, and deep understanding of the BRICS markets, we provide unparalleled opportunities for businesses looking to expand their footprint in these vibrant economies. We pride ourselves on being a catalyst for innovation and economic progress in one of the world’s most promising economic blocs.

Our Mission

The company started its activities under the new name "BRICS Bridge" from January 1, 2024. In response to global changes, we have decided to limit our activities in West Africa, England, and Turkey and focus specifically on the markets of the BRICS Plus region. This initiative aims to facilitate trade among the BRICS member countries and those newly joining this group.

Our Achievements in 2024

What we did during January!

The activities of our companies in the three regions of England, West Africa, and Turkey have been consolidated and placed under the umbrella of the central company in Beijing since the beginning of 2024. However, the activities of our other companies in China, Oman, and Hong Kong continue as before. Despite Oman not being a member of the BRICS Union, due to its special role as a bridge between Saudi Arabia, and the United Arab Emirates in the Middle East, it will continue its valuable activities with higher appreciation.

In the pursuit of our set goals, shortly after the start of 2024, we transferred the centralization and control of our subsidiary offices from Hong Kong to Beijing while maintaining the Hong Kong office. We have also established a new company called “BRICS Bridge” to facilitate supplier KYC processes, verification, banking services, transportation, and storage. Additionally, with active presence in Africa, an MOU has been executed with “South Africa” as a BRICS member country to secure food and mineral supplies.

The high potential of the proposed plan and the possibility of direct exports with China have made this contract interesting and led to successful results in a short period. Our motivated and creative team is pursuing innovative achievements in the traditional market.

Our History

Starting our journey into the future

Our Core

Our current processing situation

Our Solutions

Bridging Nations, Uniting Markets

After achieving the goals of 2024 and assessing a pilot example, we intend to expand the platform’s services to Arab countries in 2025 and strengthen their direct connection with the Chinese market. Furthermore, in the development perspective until 2030, we envision the platform as a central and usable strategy in BRICS+ member countries and even beyond this agreement. Our goal on this path is to establish direct communication, facilitate, and expedite commercial affairs among suppliers and traders across BRICS+ member countries.

This innovative move in the world of commerce facilitates the progress of both small and large producers and accelerates international trade. It is predicted that with the inclusion of transportation and customs companies in this platform, there will be significant competition in providing fast and cost-effective services.

In addition to the above, the “BRICS Bridge” platform aims to create an active and intelligent environment that, by 2025, using artificial intelligence, improves the complex stages of sourcing, procurement, transportation, and customs. This initiative enables comprehensive information about suppliers, product HS codes, export and import volumes, and customs regulations for clearance to quickly become accessible to customers.

In the continued development, the platform, as a central and usable strategy in BRICS+ member countries and even non-member countries, aims to facilitate commercial affairs globally. This special focus internationally connects small and large developers, accelerating the flow of international trade.

As mentioned earlier, our platform intends to use artificial intelligence to create a comprehensive system to harmonize HS codes for products in China with other countries.

One common challenge in international trade is finding the HS code of the origin country. Due to the lack of a comprehensive system in China for obtaining and matching HS codes and product information, the “BRICS Bridge” platform carefully addresses this issue and resolves related problems.

This is just one of our goals in utilizing artificial intelligence. The platform allows customers to quickly find reputable suppliers for product sourcing from any point in BRICS+ member countries and receive necessary information, including export records and export laws.

This significant step presents an opportunity to enter the future of international trade, and your collaboration can enhance the speed and credibility of this future. “BRICS Bridge” platform, with its direct connection to global markets, aims to make fundamental changes in the dynamics of international trade. The young and creative team of the company is committed to providing innovative solutions that elevate the level of ease and transparency in international trade.

In the continued development of activities, we plan to enhance the level of services provided by the “BRICS Bridge” data platform. Through this platform, customers can quickly and accurately access all the necessary details for conducting business transactions in BRICS+ member countries. Additionally, our team is working on developing a comprehensive KYC system for producers and suppliers. This system allows customers to thoroughly review the commercial background and credibility of producers and suppliers and directly connect with the most reputable units for the production and supply of goods.

Ultimately, the “BRICS Bridge” platform not only helps solve common issues in business but also, by launching a comprehensive KYC system, contributes to reducing legal disputes and creating a reliable and globally recognized system. In the future, we see the position of the “BRICS Bridge” platform in creating a dynamic and coordinated ecosystem in the world of international trade. We aim to expand geographically, improve content, increase efficiency, and enhance our platform’s capabilities. By adding features and upgrading service levels, we intend to make the experience of international trade simpler and more efficient for everyone.

Potentials and capabilities

Use of facilities to facilitate exchanges

In this demonstration of the future of international trade, “BRICS Bridge” strives to address the complexities and challenges of facilitating trade between China and other countries, serving as a model for intricate and challenging trade scenarios. other countries, with its untapped potential in import and export markets, presents a unique environment where many trade transactions remain unrealized.

One significant challenge for international traders in sourcing goods from China is related to financial transactions. However, through collaboration with our international companies worldwide and leveraging our strong connections in China, “BRICS Bridge” makes solving this issue straightforward.

In the path of progress and development, we believe that continuous collaborations with traders, producers, and suppliers, especially in the Middle East and BRICS+ countries, will contribute to achieving long-term goals.

In this journey, our efforts focus on enhancing user account management capabilities, improving communication tools, and creating intelligent solutions to increase user confidence in their transactions. Moreover, we aim to establish direct connections among traders, producers, and suppliers as a global community.

We will harness the power of artificial intelligence to improve international trade processes, facilitate decision-making, and reduce potential obstacles. Our goal is to create a smart and unified platform, allowing traders and producers to continue their transactions easily and confidently.Furthermore, we are looking to develop international communications and collaborate with major trade entities to transform this innovative project into a global standard. We appreciate your continuous support and trust as our valued partners.

The “BRICS Bridge” platform, with the goal of facilitating international trade, creating new opportunities, and increasing trade collaborations, continues its journey with motivation and enthusiasm. We invite you to actively participate in this journey and share your experiences. Here’s to a bright and feature-rich future in the world of international trade.

Risks & Strategy & Solutions

Current situation

- Risk Management Strategies:

Supply chain management in Middle East and BRICS countries presents various risks, some of which are common across regions, while others are specific to particular countries.

Common Risks in Both Regions:

-

1

Geopolitical Risks

Changes in political climate, or diplomatic tensions can impact supply chain operations. For instance, trade policies in Brazil or other countries may change with new administrations.

-

2

Economic Fluctuations

Economic instability, inflation, or currency devaluation can affect costs and financial planning. Countries like South Africa and Brazil have experienced such economic fluctuations.

-

3

Logistical Challenges

Varying levels of infrastructure development across these regions can pose challenges. For example, logistical issues in remote parts of India can affect delivery times and costs.

-

4

Regulatory and Compliance Risks

Each country has its own set of regulations and compliance requirements, which can change frequently and without notice.

-

5

Cultural and Language Barriers

Misunderstandings due to language and cultural differences can lead to misaligned expectations and business practices.

Specific Risks in Middle East Countries:

-

1

Security and Conflict Risks

In countries like Syria or Iraq, ongoing conflicts and instability pose significant risks to supply chain operations.

-

2

Customs and Trade Restrictions

All asian countries.

-

3

Rapid Policy Changes

The Middle East can experience swift changes in policies, especially related to trade and foreign investment, which can impact supply chain planning.

Specific Risks in BRICS Countries:

-

1

Brazil

Risks include fluctuating economic policies, environmental regulations affecting certain industries, and potential delays due to bureaucratic processes.

-

3

India

Infrastructure bottlenecks, bureaucratic hurdles, and varied tax regimes across states can pose challenges.

-

4

China

Changing trade policies, especially in light of ongoing trade tensions with other countries, and stringent regulatory environments can affect supply chains.

-

5

South Africa

Challenges include labor unrest, power supply issues (like load shedding), and logistical challenges due to port inefficiencies.

Each country within these regions has its unique set of risks, requiring tailored strategies to navigate and manage effectively. Understanding these specific risks and planning accordingly is vital for successful supply chain management in Middle East and BRICS countries.

Payment Term Challenges in Supply Chain Management for BRICS & Middle East Markets

1. The Core Challenge: Divergent Payment Terms

• Payment Terms Mismatch: A primary challenge in supply chain management within BRICS and Middle Eastern markets involves the differing payment terms preferences. Buyers from these regions often prefer to make payments after receiving goods, while Chinese suppliers generally require full payment before cargo leaves the port in China. This mismatch creates a significant financial gap and can impede smooth transaction flow.

2. Role of Chinese Investors in Bridging the Gap

• Financial Intermediation: Chinese investors can play a crucial role in bridging this payment gap. By providing the necessary financial support, they can ensure that Chinese suppliers receive their payments upfront, while allowing buyers in BRICS and Middle Eastern countries to pay upon receipt of goods. • Enhancing Market Access: This intervention by Chinese investors not only satisfies both parties but also opens up broader market access, ensuring that more orders can be fulfilled efficiently.

3. Utilizing Insurance Policies for Risk Mitigation

• Goods Delivery and Payment Assurance: To mitigate potential risks associated with these payment terms, the use of insurance policies can be a strategic solution. Insurance can guarantee the delivery of goods to the buyer and secure the payment to the supplier. • Building Trust and Reliability: Insurance policies add a layer of security and trust in the transaction, encouraging more robust trade relations between Chinese suppliers and BRICS and Middle Eastern buyers.

4. Strategic Benefits of Resolving Payment Challenges

• Encouraging Trade and Investment: By addressing the payment term challenges effectively, we can encourage more trade and investment between China, BRICS, and the Middle East, contributing to the growth of international supply chains. • Creating a Win-Win Scenario: The involvement of Chinese investors and the application of insurance policies create a win-win scenario for all parties involved, ensuring smooth trade transactions and fostering long-term business relationships.

Risk Management Strategies:

Supply chain management in Middle East and BRICS countries presents various risks, some of which are common across regions, while others are specific to particular countries. Here’s a breakdown:

-

1

Geopolitical Risks

• Strategy: Stay informed about political developments and build relationships with local entities.

• Solution: Implement flexible supply chain strategies to quickly adapt to policy changes, and diversify sourcing and logistics routes. -

2

Economic Fluctuations

• Strategy: Conduct regular market analysis to understand economic trends.

• Solution: Utilize financial hedging tools to mitigate currency risks and adjust pricing models to account for inflation. -

3

Logistical Challenges

• Strategy: Conduct thorough logistical planning and infrastructure assessment.

• Solution: Develop alternate transportation routes and use local logistics partners to navigate infrastructural limitations. -

4

Regulatory and Compliance Risks

• Strategy: Regularly update on local laws and international trade regulations. • Solution: Hire local legal experts to ensure compliance and anticipate regulatory changes.

-

5

Cultural and Language Barriers

• Strategy: Emphasize cultural awareness and training.

• Solution: Employ multilingual staff and use local liaisons to facilitate communication and understand local business practices. -

6

Security and Conflict Risks (Middle East)

• Strategy: Continuously monitor security updates in conflict-prone areas.

• Solution: Implement comprehensive security measures and consider insurance against political risks. -

7

Customs and Trade Restrictions (Middle East)

• Strategy: Stay informed about international problems and trade restrictions.

• Solution: Develop alternative supply chains that bypass restricted routes and markets. -

8

Rapid Policy Changes (Middle East)

• Strategy: Establish a proactive monitoring system for policy changes.

• Solution: Develop a flexible business model that can quickly adapt to new regulations. -

9

Economic Policies and Bureaucracy (Brazil)

• Strategy: Engage with local experts on economic policies and bureaucratic procedures.

• Solution: Streamline processes through technology and build relationships with government entities for smoother operations. -

10

Infrastructure and Bureaucracy (India)

• Strategy: Conduct detailed infrastructure and bureaucratic process assessments.

• Solution: Partner with local firms that can navigate bureaucratic processes and infrastructure challenges. -

11

Trade Policies and Regulations (China)

• Strategy: Monitor international relations and trade policy updates.

• Solution: Diversify markets to reduce dependency on any single country and use trade management software for compliance. -

12

Labor, Power, and Logistics (South Africa)

• Strategy: Keep abreast of local labor market and power supply trends.

• Solution: Develop contingency plans for power outages and labor disputes, and use local logistic services to mitigate port inefficiencies.

Implementing these strategies requires a combination of local insights, strategic planning, and technological support. Tailoring the approach to each specific risk and region is key to successful risk management in supply chain operations.

Our Customers

How you Can Help US

Governments: Railways, Cars, Buildings,...

Importers/Exporters: MadeInChina Items

Items that doesn't produce inside China nor Importing to the china.

Our Requirements

This is how you can help us

Investment Opportunities for Chinese Financiers in Supply Chain Projects

1. Overview of Investment Landscape

• Rapidly Growing Markets: BRICS and the Middle East represent rapidly expanding markets with increasing demands in various sectors, creating lucrative investment opportunities for Chinese financiers in supply chain projects.

• Infrastructure and Technology Needs: These regions are experiencing a surge in infrastructure development and technology adoption, opening avenues for investments in logistics, digital supply chain solutions, and advanced manufacturing.

2. Role of Chinese Investors

• Financial Support and Risk Mitigation: Chinese financiers can provide essential capital for supply chain projects, bridging gaps caused by payment term mismatches. Their involvement can also mitigate financial risks associated with international trade.

• Strategic Partnerships: By investing in supply chain projects, Chinese financiers can establish strategic partnerships, enhancing China’s trade relations with BRICS and Middle Eastern countries.

• Market Expansion and Influence: Investors have the opportunity to facilitate and influence the expansion of Chinese businesses into new markets, supporting China’s global economic footprint.

3. Benefits for Investors

• High Return Potential: The burgeoning economies in BRICS and the Middle East, combined with the growing demand for advanced supply chain solutions, offer high return potential on investments.

• Diversification of Investment Portfolio: Investing in different regions and sectors allows for diversification, reducing risk and stabilizing returns.

• Access to Emerging Markets: Investments provide direct access to emerging markets, offering insights and opportunities in rapidly developing economies.

• Enhanced Global Presence: Participation in international supply chain projects elevates the global presence and reputation of Chinese financiers and companies.

4. Leveraging Technology and Innovation

• Innovation in Supply Chain: There is immense potential for implementing innovative supply chain technologies like AI, IoT, and blockchain, providing efficiency and transparency.

• Research and Development Opportunities: Investors can fund R&D initiatives, leading to advancements in logistics and supply chain management.

5. Sustainable and Ethical Investment

• Promoting Sustainable Practices: Investments can promote sustainable and ethical supply chain practices, aligning with global environmental standards and contributing to corporate social responsibility.

Strategic Plan and Collaboration Opportunities for BRICS Bridge

1. Future Collaboration and Expansion Plans

• Localized Expertise with Global Reach: With offices across BRICS and Middle Eastern countries staffed by local professionals, BRICS Bridge is adept at navigating regional markets, understanding cultural nuances, and fostering strong local partnerships.

• Mastery in International Trade: Our comprehensive knowledge of international trade practices, rules, and regulations ensures efficient and compliant handling of complex transactions across borders.

2. Advanced Banking Solutions

• Customized Financial Services: BRICS Bridge offers specialized banking solutions to facilitate smooth financial transactions. Our expertise includes currency risk management, trade finance, and leveraging local banking relationships to optimize financial flows.

• Navigating Financial Landscapes: Understanding diverse financial environments in BRICS and the Middle East, we tailor banking solutions to each project, ensuring financial robustness and compliance with regional norms.

3. Robust Risk Management Strategies

• Mitigating Trade Risks: Our approach to risk management involves comprehensive analysis and mitigation strategies, addressing market, credit, and operational risks. This ensures a secure and stable environment for our clients and partners.

• Adaptive Risk Management Frameworks: We continuously adapt our risk management frameworks to align with the evolving landscapes of international trade, safeguarding interests against unforeseen market shifts.

• Comprehensive Risk Management Strategies & solutions

• KYC Protocols: Implementing rigorous Know Your Customer (KYC) practices for both suppliers and clients to ensure transparency and legitimacy in all transactions.

• Guarantees for On-Time Payments: Securing guarantees from clients to ensure timely payments, safeguarding against default risks.

• Inspection and Quality Control: Applying thorough inspection protocols during various production stages and before cargo delivery to maintain quality standards and mitigate risks of defective or non-compliant products.

• Insurance for Transportation and Payments: Insuring international transportation and payments to protect against unforeseen events, providing an additional layer of security in our supply chain operations.

• Diversification of Suppliers and Markets: Reduce dependency on a single supplier or market by diversifying. This helps mitigate risks associated with supply chain disruptions due to geopolitical issues, natural disasters, or supplier-specific problems.

• Contractual Risk Management: Develop comprehensive contracts with clear terms and conditions, penalty clauses for non-compliance, and dispute resolution mechanisms. This can help in managing expectations and protecting against contractual breaches.

• Credit Risk Assessment: Assess the creditworthiness of suppliers and clients. This involves analyzing financial stability, past transaction histories, and market reputation to avoid potential default or non-payment risks.

• Demand Forecasting and Inventory Management: Implement advanced forecasting tools to predict demand more accurately and manage inventory levels. This reduces risks associated with overstocking or stockouts.

• Compliance with International Standards: Ensure compliance with international trade standards, including environmental, ethical, and quality standards. This reduces the risk of legal penalties and helps maintain company reputation.

• Political and Economic Analysis: Keep abreast of political and economic developments in countries of operation. Political instability, economic downturns, or changes in trade policies can significantly impact the supply chain.

• Cybersecurity Measures: Strengthen cybersecurity measures to protect sensitive supply chain data. This includes secure IT systems, regular audits, and employee training to mitigate the risk of cyber attacks.

• Flexible and Agile Supply Chain Design: Develop a flexible and agile supply chain that can quickly adapt to changes or disruptions. This includes having contingency plans and alternative logistics strategies.

• Regular Supplier Audits and Performance Reviews: Conduct regular audits and performance reviews of suppliers to ensure they meet contractual obligations and maintain quality standards.

• Training and Capacity Building: Regularly train employees in risk management practices and create a culture of risk awareness within the organization.

• Adaptive Risk Management Frameworks: Continuously adapting our risk management frameworks to align with the evolving landscapes of international trade.

4. Engagement in Diverse Projects

• Diverse Sector Involvement: BRICS Bridge is strategically aligned to participate in a wide range of projects from infrastructure to technology and renewable energy, offering expansive opportunities for effective supply chain management.

5. Innovative Solutions and Technologies

• Implementing Cutting-Edge Technologies: We aim to deploy advanced supply chain solutions like AI, blockchain, and IoT to enhance efficiency, transparency, and real-time tracking.

• Sustainable Supply Chain Practices: Embracing sustainability, we integrate environmentally friendly practices in our supply chain, focusing on reducing carbon emissions and promoting renewable energy use.

• Customized Supply Chain Models: Recognizing the unique requirements of each market, we develop tailored supply chain models that respond to specific local demands and logistical challenges.

6. Commitment to Continuous Improvement

• Ongoing Training and Development: Our dedication to training ensures our team remains knowledgeable about the latest trends and technologies in international trade and supply chain management.

Conclusion: Vision for Sustainable Growth and Partnership

• BRICS Bridge is committed to sustainable growth, technological innovation, and building mutually beneficial partnerships. With our specialized skills in international trade, banking solutions, and risk management, coupled with our innovative approach, we are poised to capitalize on the vast opportunities in the BRICS and Middle Eastern markets, leading the future of global supply chain management.

Horizon ;

our aim is to reach our goals till 2025.

By 2025, the strategic initiative aims to create robust connections between communities and global providers. This will facilitate access to a diverse range of goods and services, boosting local economies while promoting mutual growth and sustainable practices in international trade.

Join BRICS Bridge

We would love to speak with you.

Feel free to reach out using the below details.